Fixed Indemnity – Predictable & Affordable

A permanent insurance option which pays a fixed amount per medical visit or procedure, regardless of where it’s performed. Empowers people to receive care anywhere knowing ahead of time what their out of pocket cost will be.

A Different Way of Doing Insurance

Fixed indemnity insurance policies differ from traditional major medical (ACA) in a number of ways.

1) No Deductible (a deductible is the amount the insured is required to pay out of pocket before insurance benefits start to cover medical costs)

2) No Coinsurance

3) Pays pre-set amounts according to benefits schedule, not according to medical bills

4) If the pre-set benefit is higher than the billed amount, the policy holder will receive the remainder as a cash payment.

5) Health Underwriting – In order to keep costs low, fixed indemnity insurance companies ask health questions as part of the application, and the applicant must be in decent health to be approved.

Freedom of Choice

While fixed indemnity plans have national PPO networks, you are free to go to any out of network provider you wish and receive the full benefit amount.

Covered from Day 1

With no deductible to meet, you can begin receiving medical benefits as soon as your policy goes into effect. No more deductible resets on New-Years Day!

Comprehensive Coverage

While fixed-indemnity policies do not have an out-of-pocket-max, they can cover a full suite of medical services from chemotherapy to chiropractic.

Learn More About Fixed-Indemnity

Predictable Coverage From the Start

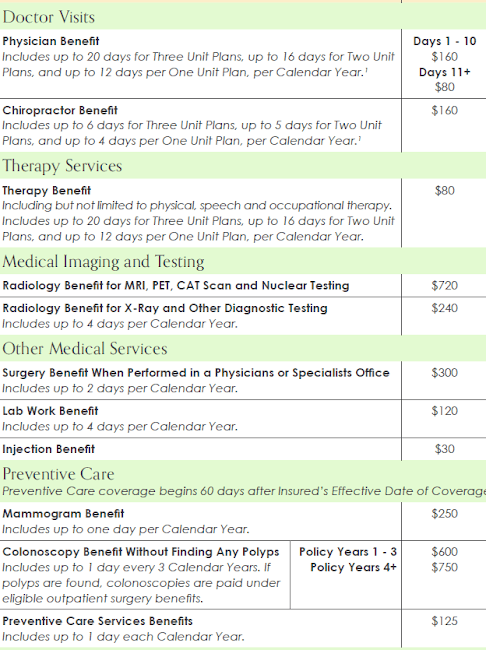

The best indemnity policies offer a wide array of covered medical services, often including chiropractic care and physical therapy. When you go to an in-network doctor, you simply show them your card like you would with any other insurance. If you had the plan shown here, you would receive $160 for every doctor’s visit. Since Florida office fees vary from $90-130, in most cases you would receive the difference in the form of a check.

If the doctor also performed an x-ray, the policy would pay out an additional $240, and similarly if lab work was also included it would pay out an additional $120 for a total of $520 for your visit to the doctor.

What about major services?

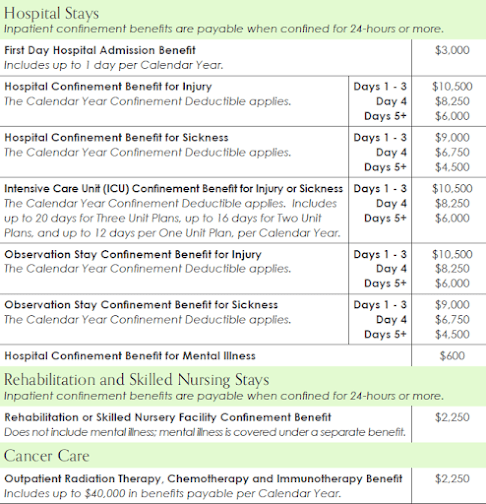

The best indemnity programs provide a comprehensive schedule of benefits that include large payouts every day you are in the hospital as well as additional money for ICU, rehabilitation and even cancer care. The average daily hospital cost in Florida is $2,600, so if your insurance policy was paying around $10,000 every day you were in the hospital, it’s possible you would receive cash back which could be used to replace lost wages.

There are of, of course, situations where medical bills may add up to more than the indemnity policy pays out. This can be considered comparable to the deductible and coinsurance associated with traditional insurance.

We empower our clients with tools to help them find the best possible price and quality of care for whatever medical attention they need. Ask us how we can help you put more money back in your pocket by being a smart shopper!

Who is Fixed-Indemnity Right For?

Fixed-indemnity insurance can be a great choice for many people. It’s simplicity is the reason for its versatility. To reduce risk, these private insurance companies have health exclusions which would prevent some people from enrolling, though once enrolled, you cannot be kicked off the policy for later health problems. Those who qualify find that the prices for this insurance are extremely low compared to major medical. A 40 year old non-smoking male can buy coverage for as low as $100 a month!

Best For:

- Healthy People

- Self-employed

- Those who can’t qualify for Obamacare subsidy

- People who like to shop for the best deal

- Those with a limited health insurance budget

- Those with an ACA subsidy (pays you to go to the doctor)

- Those with employer group care (pays you to go to the doctor)

Not Recommended For:

- Those with chronic health conditions

- Those with significant pre-existing history

- Pregnant or those looking to become pregnant

- Those who require frequent medical visits

An Example:

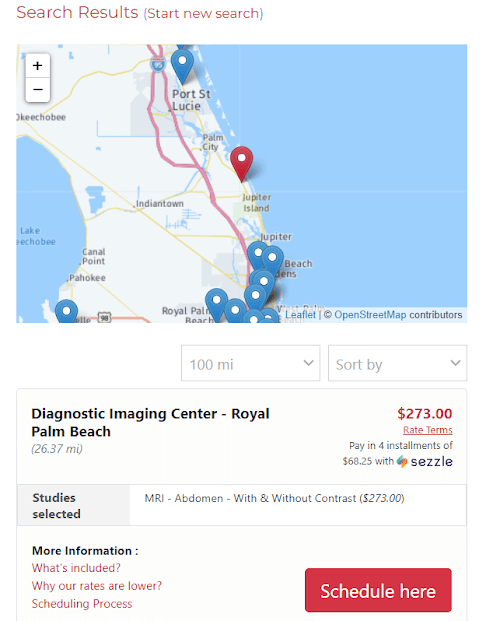

You need an abdominal MRI. Knowing that your policy pays $720 for an MRI, you use one of our free resources (or call us for help) to find the lowest priced MRI in your area, which in this example would be $273 in the Hobe Sound area. The price goes up to nearly $4,000 depending on where you go so using our free resources (or letting us check for you) can help put a lot of money back in your pocket. In this example, you would “profit” $447 using our resources. This is also why checking price is important, because it can mean the difference between coming out ahead or behind.

The best part is this works whether you are using fixed-indemnity as your main insurance or using it alongside a major medical. Even if you were paying $273 towards your ACA deductible, you would still get a check in the mail for $447 just for being a smart shopper. That is power to the consumer!